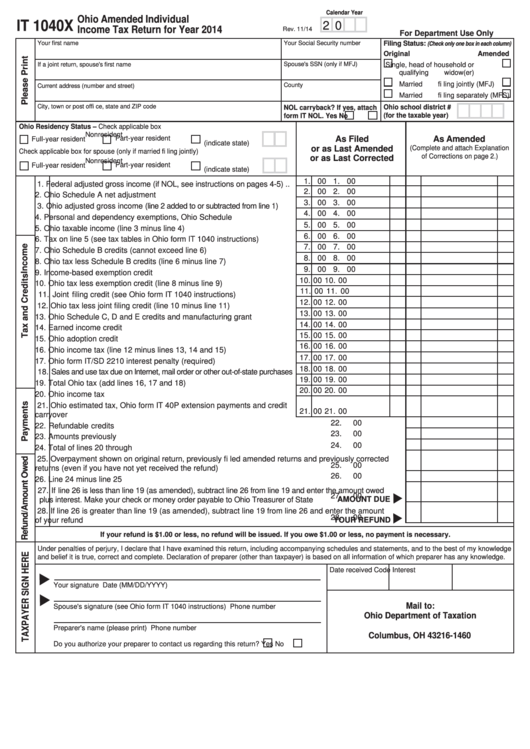

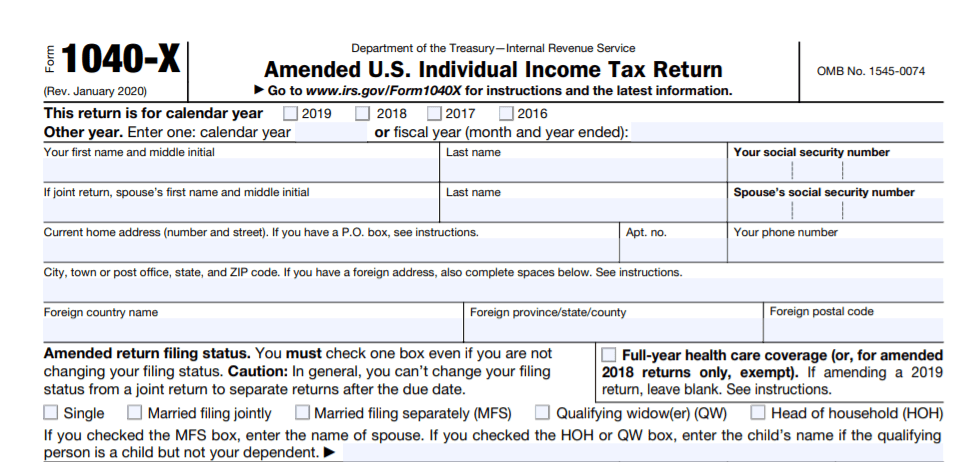

The IRS recommends filing an amended return in order to correct the error. An error on your filing status, however, would require you to file an amended tax return. According to the IRS, certain mistakes like mathematical errors, may not call for an amended return because those are typically rectified when your original return is being processed.

If you discovered an error on your tax return but haven’t filed an amended return just yet, you’ll want to figure out if your situation requires to do so.

Amended tax returns can take a while to process but it is the IRS’s responsibility to ensure they are. If you landed on this article because you are looking for help with the IRS, or if you’re wondering “where’s my amended return?”, then rest easy knowing your return will likely be issued. No matter where you went wrong or how your incorrect return impacted you, filing an amended tax return can resolve your dilemma. Perhaps your income was calculated wrong, your filing status has changed, or maybe you’ve just made a simple mathematical error that threw your filing calculations out of sorts. The truth is, the stress of tax season can translate to mistakes on your tax return which could then cause you to miss out on a tax refund or have you owing money to the IRS when you shouldn’t have. Even if you’ve filed your own taxes year after year, fulfilling your fiscal duty as an American taxpayer doesn’t always get easier each April.

0 kommentar(er)

0 kommentar(er)